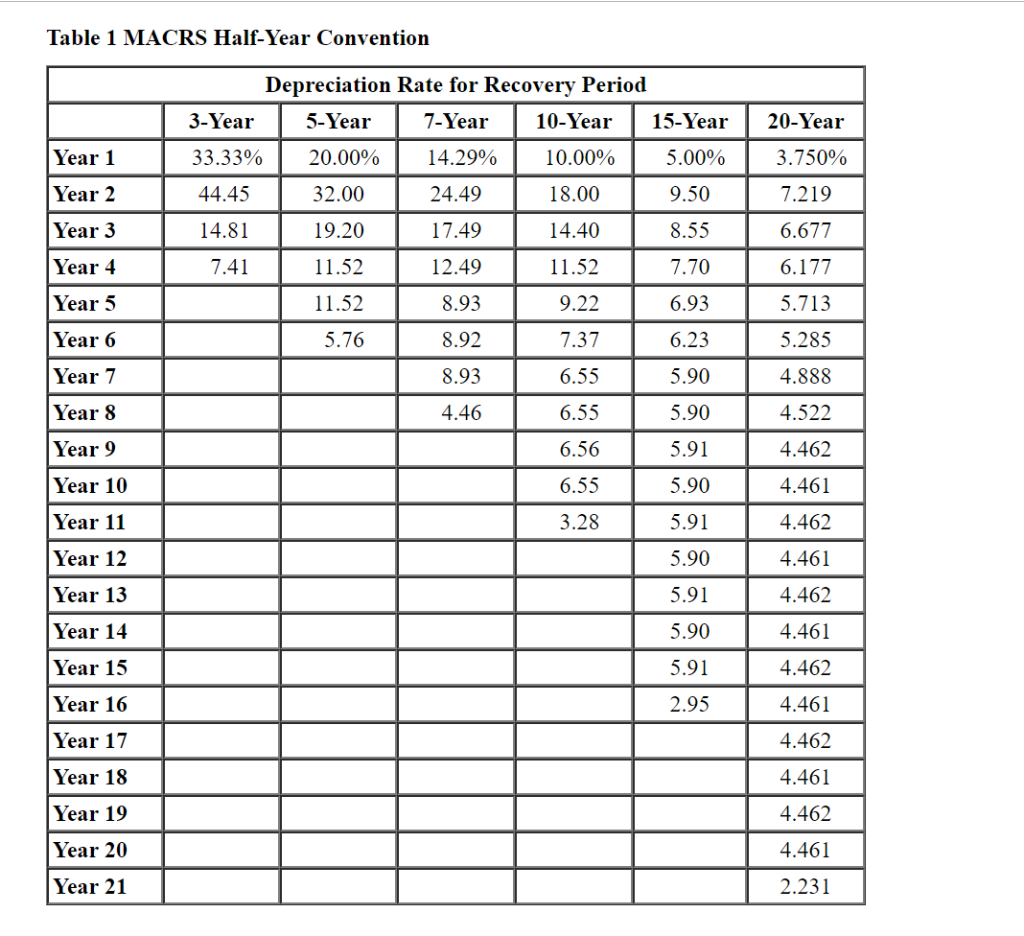

Macrs Depreciation Rate Table A-1 & A-2 . as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. These tables are used to determine the percentage rate used in calculating the depreciation of property. depreciation for financial year 2009 can also be calculated using rates given in table. From this table, you can get the depreciation rate allowed for each year of the asset’s. you can find a full list of the tables in irs pub 946, appendix a. Macrs depreciation tables help you write off the cost of business assets on your taxes.

from www.chegg.com

as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. From this table, you can get the depreciation rate allowed for each year of the asset’s. Macrs depreciation tables help you write off the cost of business assets on your taxes. These tables are used to determine the percentage rate used in calculating the depreciation of property. you can find a full list of the tables in irs pub 946, appendix a. depreciation for financial year 2009 can also be calculated using rates given in table.

Solved Table 1 MACRS HalfYear Convention Depreciation Rate

Macrs Depreciation Rate Table A-1 & A-2 you can find a full list of the tables in irs pub 946, appendix a. These tables are used to determine the percentage rate used in calculating the depreciation of property. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. you can find a full list of the tables in irs pub 946, appendix a. depreciation for financial year 2009 can also be calculated using rates given in table. Macrs depreciation tables help you write off the cost of business assets on your taxes. From this table, you can get the depreciation rate allowed for each year of the asset’s.

From www.chegg.com

Solved Table 1 MACRS HalfYear Convention Depreciation Rate Macrs Depreciation Rate Table A-1 & A-2 Macrs depreciation tables help you write off the cost of business assets on your taxes. From this table, you can get the depreciation rate allowed for each year of the asset’s. you can find a full list of the tables in irs pub 946, appendix a. depreciation for financial year 2009 can also be calculated using rates given. Macrs Depreciation Rate Table A-1 & A-2.

From cabinet.matttroy.net

Macrs Depreciation Table Matttroy Macrs Depreciation Rate Table A-1 & A-2 depreciation for financial year 2009 can also be calculated using rates given in table. Macrs depreciation tables help you write off the cost of business assets on your taxes. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. These tables are used to determine the percentage rate used in calculating. Macrs Depreciation Rate Table A-1 & A-2.

From www.chegg.com

Solved Table 1 MACRS HalfYear Convention Depreciation Rate Macrs Depreciation Rate Table A-1 & A-2 as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. depreciation for financial year 2009 can also be calculated using rates given in table. Macrs depreciation tables help you write off the cost of business assets on your taxes. These tables are used to determine the percentage rate used in calculating. Macrs Depreciation Rate Table A-1 & A-2.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Macrs Depreciation Rate Table A-1 & A-2 These tables are used to determine the percentage rate used in calculating the depreciation of property. From this table, you can get the depreciation rate allowed for each year of the asset’s. depreciation for financial year 2009 can also be calculated using rates given in table. as promised, here are the macrs depreciation tables referenced in the macrs. Macrs Depreciation Rate Table A-1 & A-2.

From www.chegg.com

TABLE 113 MACRS Depreciation for Personal Property Macrs Depreciation Rate Table A-1 & A-2 you can find a full list of the tables in irs pub 946, appendix a. These tables are used to determine the percentage rate used in calculating the depreciation of property. From this table, you can get the depreciation rate allowed for each year of the asset’s. depreciation for financial year 2009 can also be calculated using rates. Macrs Depreciation Rate Table A-1 & A-2.

From brokeasshome.com

200 Db Mq Depreciation Table Macrs Depreciation Rate Table A-1 & A-2 Macrs depreciation tables help you write off the cost of business assets on your taxes. These tables are used to determine the percentage rate used in calculating the depreciation of property. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. From this table, you can get the depreciation rate allowed for. Macrs Depreciation Rate Table A-1 & A-2.

From brokeasshome.com

Irs Depreciation Tables 2018 Macrs Depreciation Rate Table A-1 & A-2 you can find a full list of the tables in irs pub 946, appendix a. These tables are used to determine the percentage rate used in calculating the depreciation of property. depreciation for financial year 2009 can also be calculated using rates given in table. From this table, you can get the depreciation rate allowed for each year. Macrs Depreciation Rate Table A-1 & A-2.

From brokeasshome.com

Macrs Depreciation Table 7 Year Property Macrs Depreciation Rate Table A-1 & A-2 These tables are used to determine the percentage rate used in calculating the depreciation of property. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. From this table, you can get the depreciation rate allowed for each year of the asset’s. depreciation for financial year 2009 can also be calculated. Macrs Depreciation Rate Table A-1 & A-2.

From awesomehome.co

Macrs Depreciation Table 2017 39 Year Awesome Home Macrs Depreciation Rate Table A-1 & A-2 Macrs depreciation tables help you write off the cost of business assets on your taxes. you can find a full list of the tables in irs pub 946, appendix a. From this table, you can get the depreciation rate allowed for each year of the asset’s. depreciation for financial year 2009 can also be calculated using rates given. Macrs Depreciation Rate Table A-1 & A-2.

From www.chegg.com

Solved Table A2. 3, 5, 7, 10, 15, And 20Year Prope... Macrs Depreciation Rate Table A-1 & A-2 From this table, you can get the depreciation rate allowed for each year of the asset’s. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. Macrs depreciation tables help you write off the cost of business assets on your taxes. These tables are used to determine the percentage rate used in. Macrs Depreciation Rate Table A-1 & A-2.

From www.wikihow.com

How to Calculate Depreciation on Fixed Assets (with Calculator) Macrs Depreciation Rate Table A-1 & A-2 From this table, you can get the depreciation rate allowed for each year of the asset’s. depreciation for financial year 2009 can also be calculated using rates given in table. Macrs depreciation tables help you write off the cost of business assets on your taxes. These tables are used to determine the percentage rate used in calculating the depreciation. Macrs Depreciation Rate Table A-1 & A-2.

From brokeasshome.com

Macrs Depreciation Table 7 Year Property Macrs Depreciation Rate Table A-1 & A-2 as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. These tables are used to determine the percentage rate used in calculating the depreciation of property. depreciation for financial year 2009 can also be calculated using rates given in table. Macrs depreciation tables help you write off the cost of business. Macrs Depreciation Rate Table A-1 & A-2.

From awesomehome.co

Macrs Depreciation Table 27 5 Awesome Home Macrs Depreciation Rate Table A-1 & A-2 These tables are used to determine the percentage rate used in calculating the depreciation of property. Macrs depreciation tables help you write off the cost of business assets on your taxes. you can find a full list of the tables in irs pub 946, appendix a. as promised, here are the macrs depreciation tables referenced in the macrs. Macrs Depreciation Rate Table A-1 & A-2.

From awesomehome.co

Macrs Depreciation Table 2017 Awesome Home Macrs Depreciation Rate Table A-1 & A-2 Macrs depreciation tables help you write off the cost of business assets on your taxes. These tables are used to determine the percentage rate used in calculating the depreciation of property. depreciation for financial year 2009 can also be calculated using rates given in table. as promised, here are the macrs depreciation tables referenced in the macrs depreciation. Macrs Depreciation Rate Table A-1 & A-2.

From www.slideserve.com

PPT L23 Tax Depreciation PowerPoint Presentation, free download ID Macrs Depreciation Rate Table A-1 & A-2 From this table, you can get the depreciation rate allowed for each year of the asset’s. These tables are used to determine the percentage rate used in calculating the depreciation of property. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. depreciation for financial year 2009 can also be calculated. Macrs Depreciation Rate Table A-1 & A-2.

From alquilercastilloshinchables.info

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog Macrs Depreciation Rate Table A-1 & A-2 From this table, you can get the depreciation rate allowed for each year of the asset’s. you can find a full list of the tables in irs pub 946, appendix a. Macrs depreciation tables help you write off the cost of business assets on your taxes. as promised, here are the macrs depreciation tables referenced in the macrs. Macrs Depreciation Rate Table A-1 & A-2.

From alquilercastilloshinchables.info

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog Macrs Depreciation Rate Table A-1 & A-2 These tables are used to determine the percentage rate used in calculating the depreciation of property. From this table, you can get the depreciation rate allowed for each year of the asset’s. depreciation for financial year 2009 can also be calculated using rates given in table. you can find a full list of the tables in irs pub. Macrs Depreciation Rate Table A-1 & A-2.

From www.jdunman.com

Publication 946, How To Depreciate Property; Appendix A Macrs Depreciation Rate Table A-1 & A-2 These tables are used to determine the percentage rate used in calculating the depreciation of property. From this table, you can get the depreciation rate allowed for each year of the asset’s. as promised, here are the macrs depreciation tables referenced in the macrs depreciation table guide provided above. you can find a full list of the tables. Macrs Depreciation Rate Table A-1 & A-2.